Mastering the Art of Reading Merchant Processing Statements

- merchantstatement

- Apr 10

- 3 min read

Updated: Jul 6

Merchant account statements can often feel overwhelming, packed with confusing terminology and figures. Yet, these documents are vital for understanding the true cost of payment processing for merchants. By mastering how to read these statements, agents and Independent Sales Organizations (ISOs) can not only help their clients save money but also enhance their own effectiveness in the industry.

Understanding these statements is more than just a curiosity; it’s essential for ensuring that merchants maximize savings and streamline their payment processing.

The Complexity of Merchant Account Statements

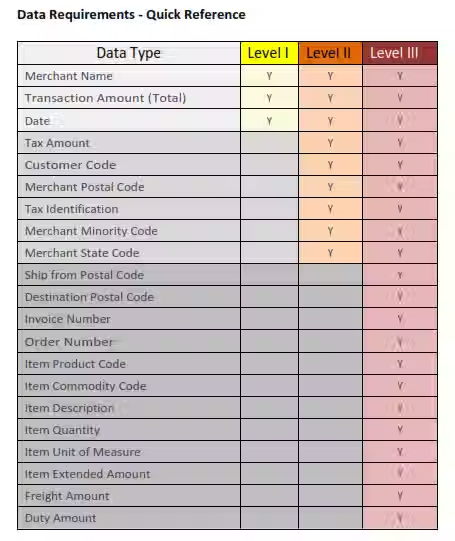

Merchant account statements are usually filled with a sea of numbers, percentages, and fee descriptions that can easily confuse even experienced professionals. Terms like “interchange fees,” “monthly minimums,” “chargeback fees,” and “processor markup” often leave agents and merchants scratching their heads.

To illustrate, consider this example: A merchant might have interchange fees that range from 1.5% to 3.5% of each transaction, depending on the type of card used. If a merchant processes $10,000 monthly, these fees can cost anywhere from $150 to $350. The complexity of the statement can lead to missed savings opportunities and can leave both merchants and agents uncertain about costs.

The good news is that by learning how to effectively read and analyze these statements, you can empower both yourself and your clients—ultimately turning confusion into clarity.

Why You Need Expert Help

Companies like Merchant Statement Analysis specialize in deciphering complex merchant account statements. Their expertise provides valuable insights for agents and ISOs alike.

For example, when you understand a client's current processing fees in detail, you can present a strong case for switching to your services. Merchant Statement Analysis offers a visual comparison of rates, highlighting potential savings. This information can significantly boost your confidence when discussing fees with potential clients. Remember, informed agents hold the cards!

White Label Analysis: Putting Your Brand First

One standout service offered by Merchant Statement Analysis is their white label analysis. This feature allows agents to brand the analysis with their company name and logo, enhancing their professional image and building trust with merchants.

When you present an analysis that appears to come directly from your own company, it communicates commitment and expertise. For instance, a payment processing agent who provides a clear, branded analysis is far more likely to gain a merchant’s confidence and trust than one who sends a generic report.

Benefits of Using Merchant Statement Analysis

Here are specific benefits of utilizing Merchant Statement Analysis:

1. Time and Cost Efficiency

Reading and analyzing merchant account statements takes time. By outsourcing this task to experts, agents can focus on building their client base. For example, instead of spending hours deciphering statements, agents can use that time to acquire new clients. Time saved translates directly to increased earnings.

2. Confidence in Your Offering

With a clear analysis, you can confidently present the potential savings merchants can achieve by switching to your services. For instance, a well-prepared agent can explain a fee structure with clear numbers, leading to stronger relationships with merchants.

3. Building Trust

Providing merchants with a detailed analysis shows genuine concern for their financial well-being. It reassures them that you are not merely focused on selling your services but also dedicated to helping them improve their bottom line.

4. Increased Sales Opportunities

Understanding and analyzing merchant account statements can lead to more productive discussions with clients. By presenting clarity on fees, you can help merchants see the value in your offerings, significantly increasing your chances of closing new deals.

Comments