The Real Cost of Business Credit Cards for Merchants: What You Need to Know

- merchantstatement

- Jul 10, 2025

- 5 min read

Business credit cards are a staple in today’s commercial economy. For many companies, they offer a convenient way to manage spending, track purchases, and even earn rewards. However, from the merchant’s perspective, these cards come with hidden complexities—especially when it comes to payment processing costs, interchange fees, and card-not-present (CNP) transactions.

While business credit cards provide flexibility and value for cardholders, they can be disproportionately expensive for merchants. Let’s explore how business credit cards can impact payment processing fees, why certain transactions get interchange downgrades, and what merchants can do to optimize for Level 2 or Level 3 interchange rates.

Understanding Interchange Fees and Business Cards

Interchange fees are the fees merchants pay to the cardholder’s bank every time a credit card transaction is processed. These fees are typically a percentage of the transaction amount plus a fixed fee. For example, a typical Visa business card might have a base interchange rate of around 2.10% + $0.10, but that rate can climb depending on how the transaction is processed.

With business credit cards, interchange fees are often higher than those for consumer cards because:

They offer higher rewards to the cardholder (which need to be funded somehow),

They’re designed for higher-ticket transactions,

They are frequently used in non-face-to-face environments, which carries more fraud risk.

The Hidden Pitfalls: Interchange Downgrades

Interchange rates aren’t fixed. The amount a merchant pays can increase significantly due to interchange downgrades.

What is an Interchange Downgrade?

A downgrade occurs when a transaction doesn’t meet the criteria for the optimal interchange category. For example, instead of qualifying for a Level 2 or Level 3 interchange rate, a transaction might fall back to a more expensive standard or EIRF (Electronic Interchange Reimbursement Fee) rate.

These downgrades can happen for several reasons:

The merchant fails to provide enhanced data (required for Level 2/3 processing),

Transactions are submitted late,

Authorization doesn’t match the final settlement,

The card is used in a card-not-present (CNP) scenario without additional verification.

Downgrades are particularly costly for merchants who process large invoices or B2B sales. What could’ve been a 1.90% interchange rate may balloon to 2.65% or more simply because of missing line-item details or address mismatches.

Card-Not-Present Transactions: A Double-Edged Sword

Business credit cards are often used in card-not-present situations—such as over the phone, online, or through emailed invoices. These transactions pose a higher risk of fraud, which makes card networks charge more for processing them.

Card-not-present (CNP) transactions tend to:

Have higher base interchange rates,

Miss out on Level 2/3 qualification,

Be more susceptible to chargebacks and fraud flags.

While it's not always feasible to avoid card-not-present transactions, merchants should be aware that these are inherently more expensive and may lead to a higher volume of interchange downgrades.

Level 2 and Level 3 Interchange: The Merchant’s Opportunity

Most merchants are familiar with standard credit card processing, but fewer take advantage of Level 2 and Level 3 data submission, which can significantly reduce interchange costs on business cards.

What are Level 2 and Level 3 Transactions?

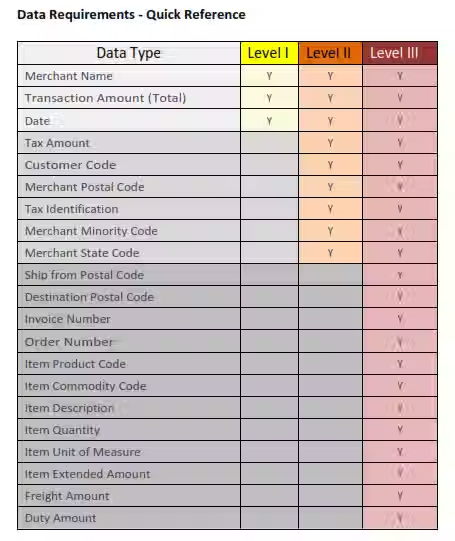

Level 2 and Level 3 transactions involve sending additional information along with the payment, such as:

Tax amount

Invoice number

Customer code

Line-item details (description, quantity, unit cost, etc.)

Merchant ZIP code

This level of detail helps the card networks verify that the transaction is legitimate and lowers the risk associated with the payment. In return, merchants benefit from lower interchange rates.

For example:

A Visa Commercial Level 3 transaction may be processed at 1.90% + $0.10, plus the additional 0.05% Visa Commercial Enhanced Data Program (CEDP) Fee*, instead of the standard 2.65% + $0.10.

On a $5,000 transaction, that’s a $35 difference per sale—just from submitting the correct data.

Why Aren’t More Merchants Using Level 2/3 Processing?

Many merchants don’t realize they’re eligible to submit Level 2/3 data, or they don’t have the technology to do it. Invoices processed manually, through standard payment gateways, or over the phone rarely meet Level 2/3 requirements.

Moreover, if the merchant’s gateway or terminal isn’t configured correctly, even if the data is available, it may not be transmitted properly—leading to interchange downgrades.

The Impact of Business Credit Cards on Merchant Margins

Here’s the real kicker: for B2B companies that regularly accept business cards for high-ticket transactions, the difference in interchange fees can drastically affect profit margins.

Let’s say a merchant processes $100,000 in monthly business card volume:

Without Level 2/3 data and with frequent downgrades, their effective rate might be 2.95%, costing $2,950/month.

With proper Level 3 optimization, their rate might be 1.90% plus the 0.05% CEDP fee, for a total of 1.95%. This would cost $1,950/month.

That’s a $1,000 monthly difference—or $12,000 annual savings!

For wholesalers, manufacturers, law firms, consultants, and government contractors, that level of savings can be transformative.

How Merchants Can Mitigate Costs

If you're a merchant processing business credit cards, here are steps you can take to minimize interchange costs:

1. Upgrade Your Payment Gateway

Ensure your payment platform supports Level 2 and Level 3 data fields. Not all processors do, and some charge extra for this feature, but the savings can far outweigh the cost.

2. Automate Data Collection

Use invoicing tools or ERP systems that automatically pass enhanced data to your gateway during checkout or invoice payment.

3. Avoid Manual Entry When Possible

Manual entry (keyed-in cards) is more likely to trigger downgrades and fraud flags. Use tokenized, secure methods like online portals, invoice links, or stored payment profiles.

4. Settle Transactions Promptly

Settle the transaction on the same day it’s authorized. Delayed settlements often lead to interchange downgrades.

5. Verify Address and Zip Code

Always perform AVS (Address Verification Service) checks for CNP transactions to increase the likelihood of qualifying for better rates.

6. Educate Your Staff

Make sure your accounting and operations teams understand how data entry impacts interchange. A small oversight can cost hundreds of dollars per transaction.

The Bottom Line

Business credit cards are here to stay. They’re a convenient, widely used payment method in the B2B ecosystem. However, for merchants, they’re a double-edged sword. Between high interchange rates, card-not-present risk, and missed Level 2/3 qualifications, the cost of accepting these cards can quietly eat into margins.

But it doesn’t have to.

With the right systems in place and a proactive approach to payment processing, merchants can reduce interchange costs, avoid downgrades, and ultimately make business credit card acceptance more profitable.

If you're not already optimizing for Level 2 and Level 3 transactions—or working with a payment processor that understands these complexities—it may be time to reassess your setup. Every percentage point counts when you're operating in the B2B space.

Need help optimizing your payment processing for business credit cards?

Talk to your payment provider or consult with a merchant services expert who specializes in B2B transactions. A few small changes can make a big financial impact.

*As of April 2025, Visa charges a Visa Commercial Enhanced Data Program (CEDP) Fee of 0.05% to all transactions that qualify for Visa Level 2 or Visa Level 3 interchange programs.

Comments