Uncover Hidden Savings: The Ultimate Guide to Merchant Account Comparison for Optimized Profitability

- merchantstatement

- Apr 6, 2025

- 4 min read

Updated: Jul 6, 2025

In the fast-paced world of retail and services, every penny saved matters. Whether you are a small business owner or a large retail chain, you know how crucial financial decisions are for your bottom line. One area often overlooked is merchant statement analysis, which can reveal hidden savings in your merchant accounts.

Merchant account comparison can feel overwhelming, but you do not have to struggle. This guide will clarify the process and help you explore your options effectively.

What is Merchant Statement Analysis?

Merchant statement analysis involves closely examining your credit card processing statements. By reviewing transaction details, fees, and chargebacks, you can identify unnecessary costs and find opportunities for savings.

Many merchants overlook discrepancies in their merchant discount rates and extra charges, leading to wasted dollars.

By optimizing these costs, you can considerably increase profitability. Here’s how to conduct this analysis effectively.

The Importance of Merchant Account Comparison

Merchant account comparison is vital because it allows you to evaluate different providers based on services and fees. Choosing the wrong merchant account can lead to inflated costs that eat into profits—something no merchant should endure.

When comparing merchant accounts, consider the following:

Transaction Fees: Providers have different transaction fees. While one company may advertise a lower rate, check for hidden fees that may negate that perceived savings.

Monthly Maintenance Fees: Some providers charge fixed monthly fees. Understand these charges to calculate the actual cost of your processing.

Equipment Costs: If you need credit card terminals, factor in the purchase or rental costs.

Customer Support: Choose providers that deliver reliable customer service. Quick issue resolution helps keep operations smooth.

Contract Length: Be sure to understand the terms of your agreements. Long contracts can be a hassle if you decide to switch providers.

By considering these factors, you can make an informed decision that positively impacts your business.

How to Conduct a Merchant Statement Analysis

The process of merchant statement analysis can be streamlined with a systematic approach. Here’s how to do it effectively:

Gather Your Statements: Collect at least three to six months of merchant statements from your current provider.

Identify Fees: Break down all fees listed in the statements. Look for transaction fees, rate inconsistencies, and any hidden costs.

Rate Consistency: Make sure your merchant account rates match what you were quoted. If not, contact your provider for clarification.

Inspect Chargebacks: Examine any chargebacks or penalties in your statements; these can substantially increase your processing costs.

Seek Alternatives: With your data in hand, compare findings against other potential providers.

Negotiate: Use your findings to discuss lower fees or better terms with your current processor.

Following these steps will give you a clear overview of your current merchant services and prepare you for negotiations or potential transitions.

Tools for Merchant Statement Analysis

Fortunately, many tools can assist you in performing an effective merchant statement analysis. Some options include:

Online Comparison Platforms: Websites designed for comparing payment processors can provide insights about fees and services.

Accounting Software: Many accounting tools generate detailed reports on transaction fees, helping you visualize and analyze your costs easily.

If you find the process overwhelming, consider working with a consultant who specializes in merchant services. Experts can help uncover savings you might not spot on your own.

Additional Benefits of Merchant Account Comparison

The advantages of merchant account comparison go beyond just saving money. Here are a few extra benefits:

Enhanced Services: New providers may offer better technology, improving transaction speed and enhancing the customer experience.

Tailored Solutions: Each business is unique. Exploring different accounts could help you find a provider that meets your specific needs.

Transparent Pricing: Keeping your current provider accountable can encourage them to offer clearer pricing, benefiting your business long term.

Risk Management: A careful review of merchant accounts may show potential risks, allowing you to address issues proactively.

By actively engaging in merchant account comparison, you not only discover hidden savings but also improve overall business operations.

,

Take Action Now

Merchant statement analysis, paired with thorough merchant account comparison, can save your business a significant amount of money, optimizing profitability. This practice helps control operational costs and maintain a competitive edge in your industry.

By carefully reviewing your merchant statements and evaluating providers, you are not just touching the surface. You are gaining a deeper understanding of your business’s financial health, which is crucial for growth.

For ISOs and Sales Agents

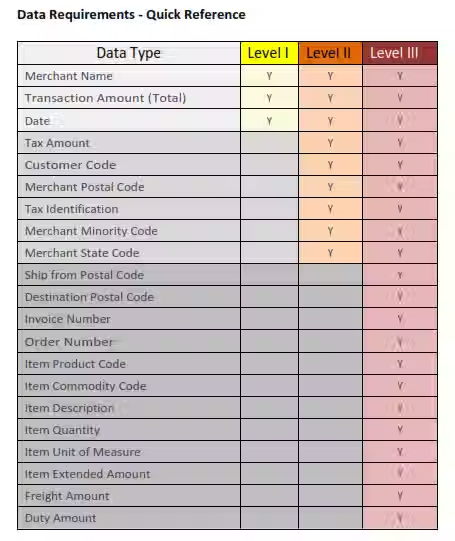

As a merchant services agent or ISO, you know that one of the most important things you can do for your merchants is to help them save money on their credit card processing fees. One of the best ways to do this is to provide them with a side-by-side comparison of their current merchant statement with your company's interchange fees.

Here are some of the benefits of providing merchant statement analysis to your merchants:

Increased savings: Merchants who switch to a new processor after receiving a side-by-side comparison of their statements can save an average of 20% on their credit card processing fees.

Improved customer service: By taking the time to analyze your merchants' statements, you are showing them that you are committed to their success. This can lead to improved customer loyalty and increased sales.

More referrals: Merchants who are happy with the savings they receive by switching to your company are more likely to refer their friends and colleagues to you. This can help you grow your business and reach new customers.

Start your analysis today and watch as hidden savings emerge. Every cent saved is a cent that can be reinvested into your business. Discover the hidden savings in your merchant accounts and maximize the returns on your hard work!

Comments